Digital Twins in Oil and Gas Market Projected To Hit $2.81 Bn by 2032 | 2025–2032 Market Outlook

Digital Twins in Oil and Gas Market

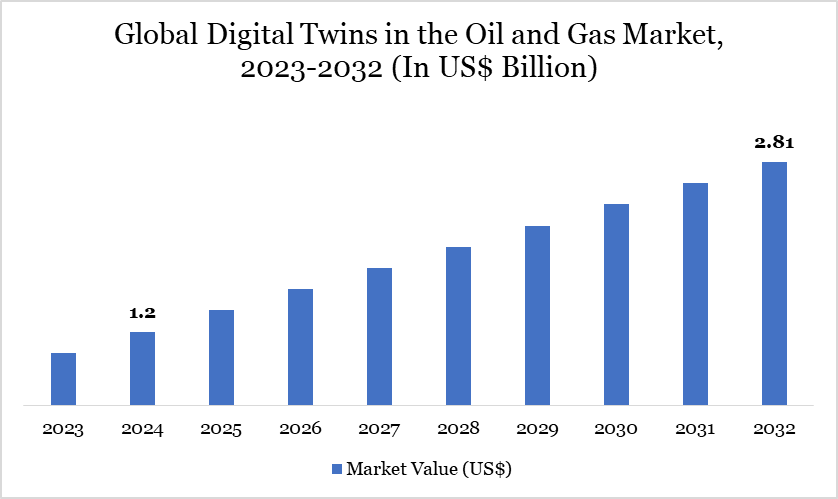

The Digital Twins in Oil and Gas Market is projected to grow from USD 1.2 Billion in 2024 to USD 2.81 Billion by 2032

AUSTIN, TX, UNITED STATES, June 23, 2025 /EINPresswire.com/ -- Market Size & Growth 2025

The global Digital Twins Oil and Gas Market Size sector was valued at USD 1.2 billion in 2024 and is projected to grow to USD 2.81 Billion by 2032, Experiencing a compound annual growth rate (CAGR) of 11.20% throughout the period from 2025 to 2032.

These technologies enable companies to create real-time virtual models mirroring rigs, pipelines, or refineries to simulate scenarios, spot inefficiencies, and head off equipment failures. That predictive edge is golden in a capital-intensive, safety-first field like oil and gas.

To Download Sample Report:https://www.datamintelligence.com/download-sample/digital-twins-in-the-oil-and-gas-market

Regional Outlook

North America

Home to roughly 30 % of current market revenue, North America leads in digital twin adoption. Operators in the US and Canada are using virtual models for midstream activities think pipelines and to manage remote assets via the cloud. Meanwhile, municipalities and oil majors alike lean on twin tech for regulatory compliance and efficiency boosts.

Middle East & Africa

This region is witnessing a steady rise in the adoption of digital twin technology. Massive onshore and offshore projects combined with a sharper cost discipline are driving investment in virtual replicas to cut downtime and improve asset management.

Asia Pacific

Fastest-growing region overall. China, India, Australia, and Japan are pushing digital twins in both oil and gas and wider industrial uses. In Japan alone, the digital twin market ballooned to nearly $1.55 billion in 2024, with an expected 28 % CAGR, thanks to heavy investment in smart manufacturing, Industry 4.0, and smart-city builds.

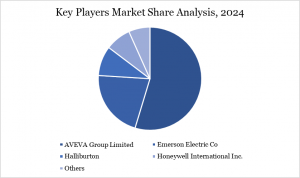

Key Market Players

Leading providers shaping this space include:

AVEVA Group Limited

Emerson Electric Co

Halliburton

Honeywell International Inc.

IBM

SLB

Microsoft Corporation

General Electric

Schneider Electric

Siemens Energy

Market Segmentation:

By Offering: Product digital twin, Process digital twin, System digital twin,

By Type: Descriptive Twin, Informative Twin, Predictive Twin, Comprehensive Twin, Autonomous Twin

By Deployment Mode: Cloud, On-premises

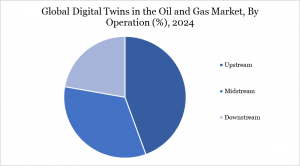

By Operation: Upstream, Midstream, Downstream

By Application: Exploration & Production, Drilling Operations, Reservoir Management, Pipeline Management, Refining Operations, Asset Performance Management, Others

Regional Analysis: North America, U.S., Canada, Mexico, Europe, Germany, U.K., France, Spain, Italy, Rest of Europe, South America, Brazil, Argentina, Rest of South America, Asia-Pacific, China, India, Japan, South Korea, Rest of Asia-Pacific, Middle East and Africa

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=digital-twins-in-the-oil-and-gas-market

Recent Developments in 2025

Process twins (for workflows like drilling or refining) emerged traditional leaders, accounting for well over 40 % of market share in 2024.

Cloud deployment grew fastest offering scalability and team collaboration while on‑premises solutions remain vital for secure or legacy environments.

A June 2025 industry event in Houston (Data Driven Oil & Gas USA) focused heavily on twin tech strategies to improve efficiency and minimize risks in global pipelines and facilities.

Meanwhile, the Oil & Gas Digital Twin Conference & Exhibition drew global stakeholders to discuss twin architectures that advance sustainability and net-zero roadmaps.

In November 2024, Venture Builder VC introduced the NOV Supernova Accelerator, a five-month program aimed at advancing digital transformation in the upstream oil and gas sector. The initiative gives startups direct access to NOV’s research and development teams and business units, allowing them to test new technologies and build sustainable partnerships. This program encourages innovation and collaborative solutions for the industry's most pressing challenges.

In 2023, the U.S. invested around US$ 200 billion in oil and gas, making up roughly 19% of global spending, according to the IEA. This substantial investment is fueling the adoption of digital twin technologies by enhancing operational efficiency and accelerating innovation across exploration, drilling, and production. With greater capital at their disposal, energy companies are deploying digital twins to minimize downtime and boost asset performance.

As an example, in June 2023, Honeywell launched Digital Prime, a cloud-based digital twin solution that helps monitor, manage, and test changes in process control systems. Digital Prime enables frequent, cost-efficient testing, reduces reactive maintenance, and enhances project execution without impacting ongoing operations.

Latest News of USA

From Houston (June 24–25, 2025), the Data Driven Oil & Gas USA event spotlighted twin deployments across major US players. A key takeaway: executives believe digital twins hold enormous potential—but struggle with integration hurdles, especially connecting legacy systems with AI-driven platforms.

A recent EY Future of Energy Survey 2025 noted approximately 50 % of oil & gas companies in the US already actively use digital twins, with an additional 92 % planning pilots. But only 14 % report that performance has fully met expectations highlighting a gap between promise and practice.

Mid‑2025 also saw major oil majors partner with cloud giants to roll out twin platforms focused on asset reliability and drilling safety.

Latest News of Japan

On June 17, 2025, Tokyo held the Japan Energy Summit & Exhibition, where JERA signed new LNG deals and presented digital twin pipeline models designed to simulate distribution networks.

Japanese shipping organizations recently joined an international twin‑sharing initiative to streamline vessel design and operations this marks Phase III of a broader digital twin framework aimed at maritime optimization.

In late 2024, JFE Steel used digital twins to pilot a virtual radiant tube burner at its Chiba plant, significantly extending operating life compared with conventional units.

In November 2024, Fujitsu introduced its “Policy Twin” for social-healthcare simulations extending twin use far beyond industry and into public welfare.

Experts Thoughts:

By mid-2025, the use of digital twin technology in the oil and gas sector reached a significant milestone in its adoption and development. From modest beginnings in plant performance to vital assets in national energy strategy, the technology today fuels smarter operations, safer assets, and bolder sustainability goals. Growth is robust and regional diversification is clear North America leads in deployment, Japan combines industrial and societal uses, and emerging economies are accelerating adoption. With the twin-driven future in motion, the next challenge for companies is delivery: turning expensive pilots into dependable systems that truly reshape how the industry works now and for the long haul.

Purchase Industry Subscription Today – Make Smarter Decisions Tomorrow: https://www.datamintelligence.com/reports-subscription

Here are the Experts Researched Related Reports By DataM intelligence

Oil and Gas Cloud Application Market Size 2025-2032

Oil and Gas Mass Flow Controller Market- Size 2025-2032

Sai Kiran

DataM Intelligence 4Market Research

+1 877-441-4866

Sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Distribution channels: Energy Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release